New interconnector projects energise African power pools

Progress towards regional (and continental) power trading, one interconnector at a time

Interconnector projects connect the electricity transmission infrastructure of neighbouring countries together, ultimately forming regional (and even continental) power pools. Interconnectors are one of the most exciting areas in Africa’s energy landscape - each one a milestone in the effort to ensure a sustainable energy future for the continent.

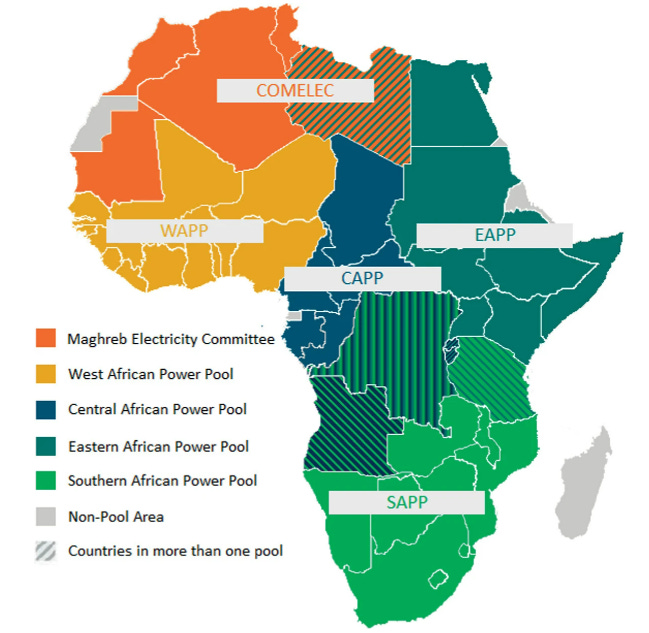

There are currently five power pools on the African continent, in different stages of development and operation:

Southern African Power Pool (SAPP), which will connect the 16 member states of the Southern African Development Community

Eastern African Power Pool (EAPP), which will connect 13 countries in East Africa

West African Power Pool (WAPP), which connects the public and private power companies of 14 West African countries

Central Africa Power Pool (CAPP), or Pool Energétique De L’Afrique Centrale, which will connect 10 Central African countries

North African/Maghreb Power Pool (Comité Maghrébin de l’Electricité, COMELEC), which connects 5 Maghreb countries).

There is some overlap in membership of the power pools - for example, Tanzania is part of both SAPP and EAPP, and Angola is part of both SAPP and CAPP. These overlapping countries will play a critical role in connecting different regional power pools to each other, allowing for electricity trading across different parts of the continent.

Of note also is the Africa Single Electricity Market (AfSEM), an initiative that aims to create an integrated continental electricity market. AfSEM was launched in 2018/19 by the African Union Development Agency (AUDA-NEPAD) and its Programme for Infrastructure Development in Africa (PIDA). Once fully operational, AfSEM will be one of the largest electricity markets in the world.

There are continual developments across all the power pools, but in this post we will focus on EAPP developments.

Recent progress in EAPP

In December 2024, power began to flow through the 400 kV Kenya-Tanzania Power Interconnection Line, connecting the electricity grids of Kenya and Tanzania, while also synchronising them with the grids of Uganda, Rwanda, Burundi, and the DRC.

With the Kenya-Ethiopia interconnection having come online in 2022, Ethiopia will now be able to trade its surplus renewable energy beyond Kenya to Tanzania and other EAPP countries, maximising utilisation of new generation achieved with the July 2025 completion of the 5,000 MW Grand Ethiopian Renaissance Dam. Tanzania’s power utility, TANESCO, has already signed a power purchase agreement with Ethiopian Electric Power (EEP) for 100 MW, to increase to 200 MW over the next three years. To enable this, TANESCO has entered into a wheeling arrangement with Kenya’s KETRACO for use of Kenya’s grid to convey Ethiopian electricity to Tanzania. This is the first wheeling transaction within the EAPP.

These developments constitute key steps toward boosting cross-border energy trade in East Africa, which efforts are further supported by the March 2025 commitment of EAPP members to establish a regional power market. In addition to developing interconnectors and transmission lines, establishing a regional power market necessitates harmonising regulatory frameworks and enhancing institutional capacity across EAPP. These efforts contribute significantly to regional integration.

In coming years, the EAPP will be connected to the SAPP through the Zambia-Tanzania Interconnector, work on which started in April 2025 (with completion expected in 2030), as well as the Mozambique-Tanzania Interconnector. The Zambia-Tanzania Interconnector will play a key role in boosting electricity availability in Zambia, which has suffered from power constraints for a number of years, allowing Zambia to purchase power from major renewable energy suppliers in East Africa. Importantly, it will also enable a more reliable power supply to Northern Zambia, including to mining areas where demand for power is high.

Financing the interconnectors

These transmission interconnectors are large - and very expensive - infrastructure projects. Multi-partner funding arrangements have been needed to mobilise the considerable financing needed for these projects.

The Ethiopia-Kenya interconnector runs for 1,045 km between Wolayta-Sodo in Ethiopia and Suswa in Kenya.

The total project cost was around USD 1.2 billion, with the World Bank’s IDA providing a USD 586 million credit (low- to zero-interest loan), the African Development Bank providing USD 358 million (a combination of loan and grant funding), the French development agency Agence française de développement (AFD) extending a USD 118 million loan, and the governments of Ethiopia and Kenya funding around USD 106 million.*

The Kenya-Tanzania interconnector is 510 km long, running from Isinya in Kenya to the Namanga border and onwards to Singida in Tanzania.

The total project cost was USD 309.26 million, with the African Development Bank providing a USD 145 million loan, the Japan International Cooperation Agency (JICA) extending a 11.847 billion yen loan to the Tanzanian government (around USD 109 million at the 2016 average exchange rate), and some funding from the governments of Tanzania and Kenya.

The Zambia-Tanzania interconnector is planned to be 620 km long, connecting Iringa in Tanzania to Sumbawanga in Zambia.

Financing for the project is being provided by a USD 292 million grant from the World Bank, of which USD 245 million is an IDA grant, USD 17 million is a grant from the UK’s FCDO (via ESMAP), and USD 30 million is a grant from the European Union.

More than just infrastructure

Interconnectors are more than just infrastructure projects. They offer significant benefits for African countries, both in the energy sector and beyond:

Interconnectors help to accelerate the clean energy transition, even where large-scale generation projects would be more challenging. Countries that do not yet have significant renewable energy projects feeding into their grids can purchase power generated by their neighbours from renewable sources - this may be needed as carbon pricing initiatives such as the EU’s Carbon Border Adjustment Mechanism (CBAM) comes into force. Even countries that struggle to attract investment in large-scale renewable energy projects (e.g., because of high perceived risks) can still benefit from such investments made into neighbouring countries.

Cross-border energy trading creates bigger markets, thereby encouraging more investment in large-scale renewable energy projects. Bigger markets represent greater energy demand, which improves the economic viability of electricity generation projects. This could directly unlock new investment in large-scale renewable energy projects.

Interconnectors may bring down the cost of power due to more large-scale renewable energy projects. This could help expand energy access, which is a key priority in all African countries, while mitigating the emissions that would otherwise be associated with scaling up energy access.

Greater availability of power will bolster industrialisation efforts across Africa, addressing electricity constraints that have continued to hinder industrial activities in some countries. For example, more mineral processing (which can be very energy intensive) may become possible in African countries.

Regional power trading could help manage risk from droughts and climate shocks, smoothing supply across power pools and supporting energy security and economic resilience of all African countries.

Coming years will undoubtedly see further gains from energy trading within and between regional power pools. And the race is officially on for countries to not only be renewable energy leaders on the continent, but renewable energy providers for the continent!

* These approved financing figures are slightly higher than actual disbursed funding ended up being.

If you enjoyed this post and are keen to read about other African mining and energy developments, please subscribe!